You would have to live on Mars or at least own property there not to have read, heard or been informed about the Australian Taxation Office’s crackdown on investors claiming repairs and maintenance on additional expenditure incurred (spent) on their investment properties.

By JAMES HANNAH

To most investors, the mention of repairs, maintenance and capital works draws looks of bewilderment. To the uninitiated it’s almost as confusing as the Tax Act’s ‘A Simple Guide to Property Depreciation’.

Most investors leave the technical workings of what to claim to their accountant. However, investors who file their own personal returns – and even those who don’t – should understand the differences between repairs and maintenance and capital expenditure.

Put simply, if you were to claim ‘Repairs and Maintenance’ on an asset which cost $2,500 you would receive a 100% deduction and claim the total cost of the asset in that financial year. However, if the same asset were to be claimed as a capital item, then the first year, claim would be $62.50 and $62.50 thereafter for the next 39 years. As you can see, it’s important to understand the difference between a repair and an improvement as the tax treatment is quite different!

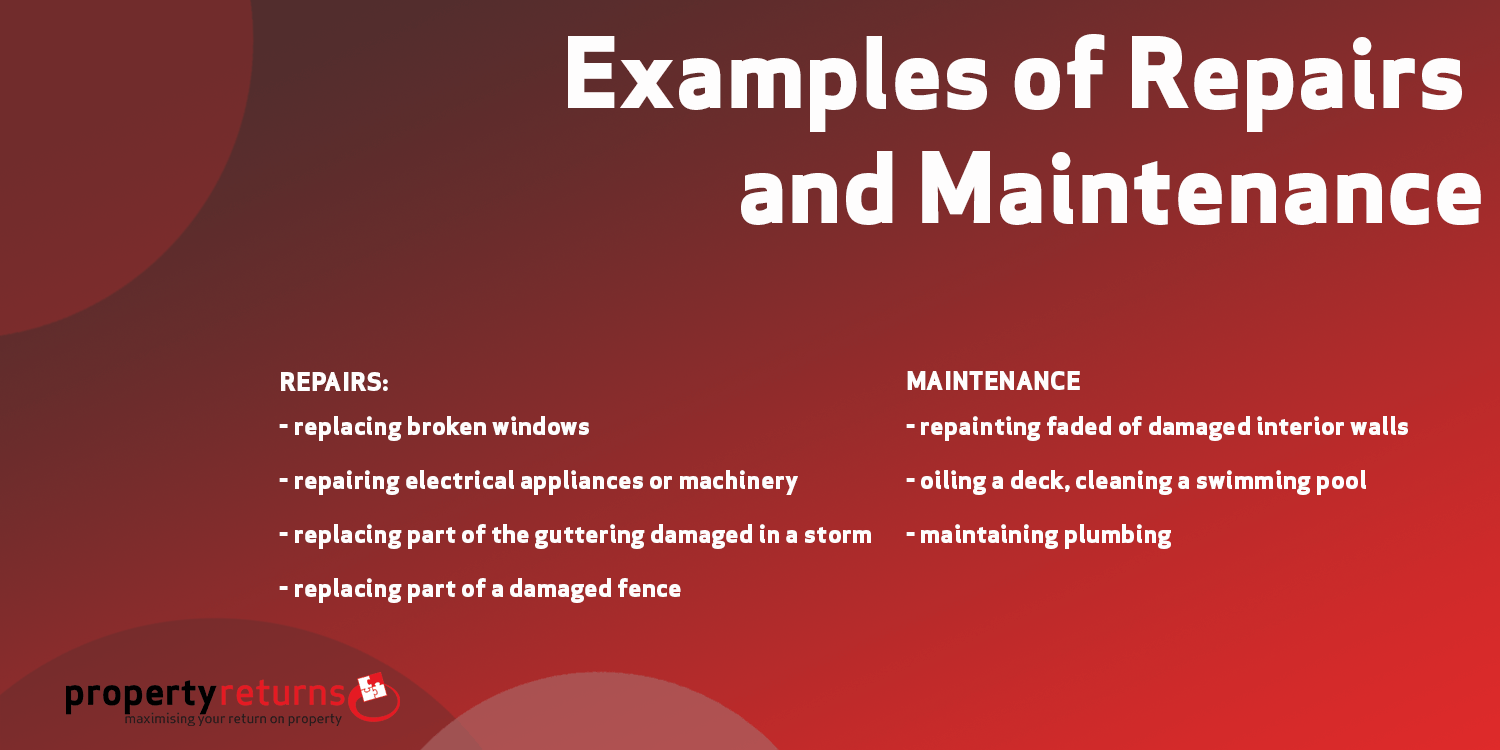

Definition of Repairs

Expenditure for repairs you make to the property may be an allowable deduction. However, the repairs must relate directly to wear and tear or other damage that occurred as a result of your renting of the property. Repairs generally involve a replacement or renewal of a worn out or broken part – for example, replacing damage from a storm, fire or simply an accident. It’s worth noting, though, that if the claim was covered by insurance, then it would not qualify for any deduction as the cost of replacement was borne by the insurance company. A simple rule of thumb test to determine if eligible for a deduction would be – was the work performed to repair the property, or was it to improve the property? Of course, this begs the question – isn’t repairing the property improving the property?

In short, if you replace an asset due to the fact that it’s worn out due to usage then it would qualify for Repairs and Maintenance. If you replace the asset with a superior product, it could be deemed that you’re improving the property and your claim may be rejected. For example, suppose a hot water unit needs replacing. If you replace the 125ltr unit with a 250ltr unit then it could be claimed that you’re making an improvement, not a repair.

To comply with the tax ruling one would have to replace the asset on a “like for like” basis with no betterment. Similarly, if you were to replace an upright stove with a split system cook top and wall oven, it would be deemed that you’re not merely replacing a worn asset but making an improvement. Therefore your claim would be rejected.

It is best to consult with a quantity surveyor, before choosing a method to claim the depreciation deductions, or ordering a tax depreciation schedule.

The Australian Tax Office has provided a PDF document that has a quick reference chart which can be very useful when deciding between claiming for repairs and maintenance and Capital Allowances

To clarify the rules further I’ll provide some real-life examples from my own recent personal experiences.

Case 1. Tony owns a rental property. He decides to replace the front door with a more ‘period’ type. Although cheap, the front door is in good condition and has no broken parts to be replaced or fixed.

The expenditure involved is not for repair but merely cosmetic – an improvement. Therefore it does not qualify as Repairs and Maintenance, but may qualify for Capital Works Allowance.

Case 2. Due to a leaking seal around the tap and sink, part of the kitchen cupboards have been subjected to water damage over time. Replacing part of the kitchen cupboards that are affected would qualify as Repairs and Maintenance.

However, if Tony decided to replace the entire kitchen cupboards, then this work would not qualify for Repairs and Maintenance but may qualify for Capital Works Allowance.

Case 3. Two of the four front steps have dry rot and need replacing. This would clearly qualify for Repairs and Maintenance. Due to the cost involved and the condition of the other two steps and stringers Tony decides to replace them with steel stringers and four new.

treads. Once again, this would not qualify for Repairs and Maintenance, as it would be deemed that Tony has in fact improved the entire (whole) asset.

Case 4. A few years ago, one of my clients replaced a sump pump which was part of a larger system. The tax position was that he had improved the system with a superior pump as the efficiency of the pump was greatly improved. Although the agents stated that the older design was no longer available, his Repairs and Maintenance claim was disallowed.

Initial Repairs

It’s important to thoroughly understand the rules that apply to repairs performed on a property immediately after purchase (initial repairs.) It appears to me that this is one area in which the Australian Taxation Office is showing an increased level of interest.

In layman’s terms, if an investor purchased a property in need of repair, either because of wear and tear or damage, it’s deemed that the purchaser was aware of the condition of the asset and therefore purchased them in a state of disrepair. It was the intent of the purchaser to repair the asset and improve it. The expenditure incurred in this situation would not qualify for Repairs and Maintenance and would be treated as Capital Expenditure.

Case 5. John and Cathy purchased a small inner city terrace house. To make it attractive to prospective tenants, they undertook some minor renovations and repairs before they made the property available for lease, which consisted of: Laundry, bathroom and ensuite remodelling, painting and plumbing.

None of the above can be treated as Repairs and Maintenance as it’s classified as initial repairs therefore the cost is of a capital nature. The total expenditure of $115,240 can be claimed at 2.5% over 40 years with a yearly deduction of $2,881. This could come as quite a shock to the unwary investor, who had planned to claim 100% of many of these costs in the year they were incurred as ‘Repairs and Maintenance It’s important to note that any item of plant under $300 can be claimed in the first year of purchase regardless of whether it’s an initial purchase or not. Plant under $1,000 that qualifies for low value pooling can be claimed at 18.75% in the first year of purchase, regardless of when it was purchased, and 37.5% in subsequent years In summary, it would be wise for all investors contemplating repairs and maintenance to first speak to their accountant or a property related tax specialist As a safeguard on any quote, have the tradesperson provide details of the replacement asset to use as evidence to substantiate your claim if required.

Property investors who claim Repairs and Maintenance on Capital items always run the risk of being audited when, in fact, they’re unaware of the fact that the asset they’re replacing can be written off at its residual value at the date of disposal.

Feel free to contact us to consult and discuss with our team of tax depreciation specialists your specific circumstance.

This article appeared in the Australian Property Investor Magazine and was presented to the National Conference of the Investor Club at the Gold Coast Convention author James Hannah

a blog written by, James Hannah Tax Depreciation Specialist.

Leave A Comment