If you are the owner or tenant of a commercial building, chances are, you are often looking to maximise your tax deductions and increase your cash flow. As leaders in the depreciation evaluation industry, here at Property Returns, we consider ourselves to be somewhat of an expert authority on the topic of depreciation of commercial properties.

As such, we understand how complicated and confusing commercial property depreciation can be. In this article, we will look at what depreciation of a commercial building looks like, various important commercial depreciation rules and how you can use your commercial assets to your benefit.

What Is Commercial Depreciation?

When discussing commercial property depreciation deductions, we are talking about the loss in value a commercial property experiences over time due to wear and tear. For many businesses and commercial property owners, a thorough understanding of how to use commercial depreciation years is key when looking to maximise your tax returns and leverage business operations to your advantage.

Now I know what you’re thinking; why is my investment property losing value? Don’t most buildings appreciate in value? Most often, an increase to a property’s value results from a rise in land value. When calculating the potential claim from depreciation deductions of a commercial property, we are looking solely at the property assets or building itself. From the perspective of the Australian Tax Office (ATO), as the commercial building ages and its assets experience wear and tear, they lose a percentage of their value. This loss in value can be calculated to determine the depreciation rate for commercial buildings and claimed as a tax deduction using a tax depreciation schedule.

All commercial properties will depreciate from their date of completion, and the depreciation is calculated by the building’s effective life.

Calculating and managing your commercial building’s depreciable value is something that should be considered over the whole lifetime of the building. In a perfect world, you would have already started tracking your assets and expenses to develop a tax depreciation schedule right from the start.

However, we know this is not always the case. Whether you have just bought a commercial property, renovated, signed a new lease or are looking to finally get your act together, the services of leading quantity surveyors in Brisbane and a tax depreciation schedule will save you a significant amount of money in deductible expenses. The savings over many commercial property depreciation years can be utilised to invest and grow your business or provide extra money for other essential expenses.

What Is a Commercial Building Depreciation Schedule?

Whether you are a commercial building owner or tenant, you can utilise a commercial building depreciation schedule to your advantage. A qualified quantity surveyor and tax professional will conduct an audit of your commercial property, identify various assets, and evaluate them to calculate the depreciable value before creating a depreciation schedule. The commercial depreciation schedule will cover the depreciation of a commercial building over the lifetime of ownership and can be used to reduce taxable income.

How do you Calculate the Depreciation Rate for Commercial Building?

When looking at the potential claim from depreciation deductions of a commercial investment property, there are two categories: capital works and plant and equipment deductions.

Capital Works

Capital works, also referred to the ATO as division 43, refer to works used to produce income, such as building and structural improvements. These works can also be written off over a longer period of time than other assets. Capital works include:

- Extensions, alterations or improvements of a building

- Alterations or improvements to a leased building (e.g., shop fit outs or renovations)

- Structural Improvements such as fences, retaining walls and sealed driveways

- Earthworks for environmental protection, such as embankments

It is important to note that all building materials and non-removable assets are included in capital works.

If it isn’t possible to establish the exact cost of the capital works, you can work with a qualified quantity surveyor who will be able to help you claim commercial property depreciation with percentage-based tax deductions.

You can claim these percentage-based deductions on the full cost of the works in the year they incurred. A rate of 2.5% or 4% will be applied depending on:

- The date which construction began

- The type of capital works

- How the capital works have been used

If your capital works are concerned with environmental protection activities or land care operations, special rules apply, and there is potential to claim immediate depreciation deductions on the cost involved.

Plant and Equipment Deductions

Plant and equipment deductions, also referred to the ATO as division 40, are used to calculate the potential claim and depreciation rate for commercial building. As a tenant of a commercial building, there are many assets you may need to acquire for your business’s operation. With time, most of these assets experience wear and tear, and it is possible to calculate and claim commercial property depreciation in their value. For the claim from depreciation of a commercial building, you can claim assets such as:

- Computers and Software

- Office furniture

- Hand Tools

- Personal Protective equipment and other protective items

- Safety Equipment

- Professional Libraries

- Technical Instruments

Commercial property owners can also claim the costs incurred from insuring and repairing tools and equipment and any interest on money borrowed to purchase these items.

Eligible plant and equipment deductions also vary between industries and professions. The Australia Tax Office (ATO) has occupation and industry specific guidelines published online. If you are looking to find a more detailed explanation for your industry’s deductible assets and other commercial property rules on the claim from depreciation, get in touch with an expert quantity surveyor today at Property Returns.

If an asset is worth less than $300, you can claim an immediate tax deduction on the income for the financial year it was purchased in. If an item has a value greater than this, there are two options for calculating the assets annual commercial property depreciation with different depreciation benefits.

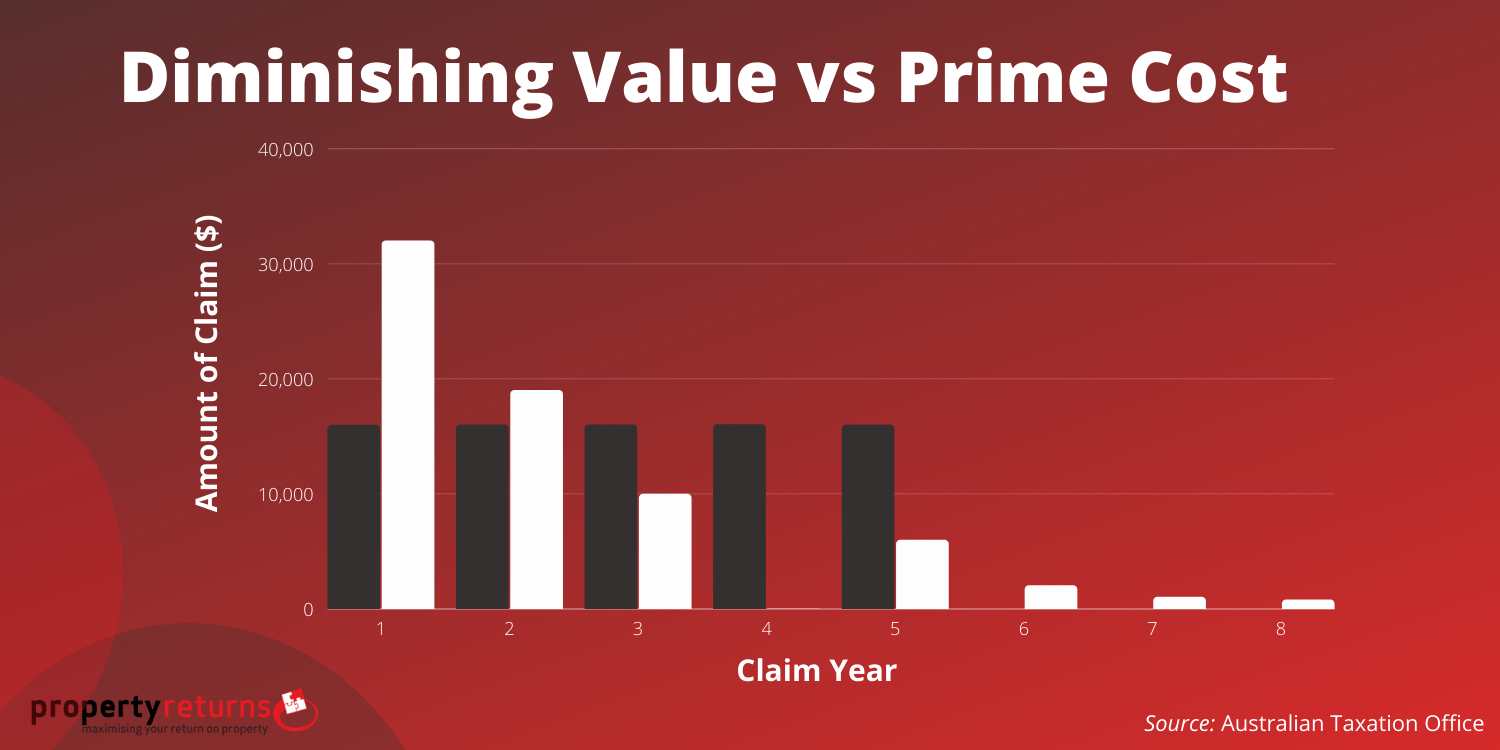

Prime Cost Method:

- The prime cost method uses the asset’s cost to calculate the depreciable value and allows you to claim a uniform fixed amount each year of the asset’s effective life.

- All capital works are claimed with this method

Diminishing Value Method:

- The diminishing value method uses the assets base value to calculate the assets depreciable value. It assumes that an asset’s rate of depreciation diminishes over the lifetime of its effective use.

The graph below visualises how commercial depreciation years differ between both the prime cost and diminishing value method. The example uses an asset that cost $80,000 and has an effective life of five years.

When used correctly, both methods can be highly effective in leveraging the operational expenses against your taxable income by calculating commercial property depreciation. The savings incurred as a result will help you to streamline your operations and grow your business.

It is important to consider how you wish to manage your assets and how it will affect your operations and cash flow. A quantity surveyor adept in commercial depreciation will be able to advise you with strategies that best suit your needs when considering both capital works and asset and plant deductions.

How Do You Claim the Depreciation of a Commercial Building?

Commercial property depreciation is a calculated amount rather than an expense. Commercial property owners will not receive a receipt or invoice, but the calculated amount will be treated as a non-cash deduction against payable tax.

This process is formalised through a commercial tax depreciation schedule created by a qualified quantity surveyor, outlining the claimable depreciable value for the building, assets and equipment. This document is then processed by an accountant who will apply the deductive expenses under division 43 capital works and division 40 depreciating assets when handling your tax. This process reduces your net profit and, as such, your tax payable. A tax depreciation schedule can be used over the lifetime of your commercial property to maximise your total depreciation deductions.

Property Returns – Specialists in Commercial Depreciation

At Property Returns, we are experts in Australian tax law, calculating commercial property depreciation and maximising your deductible returns through our commercial property tax depreciation schedules. Our expert quantity surveyors will guide you through commercial property depreciation rules and regulations to develop a personalised tax depreciation schedule that best suits your needs.

If you want to start maximising your savings and optimise your cash flow by leveraging the depreciation of a commercial building with a commercial property depreciation schedule your advantage, get in touch with us today on our website or call us on 1300 829 221.

Leave A Comment