Whether you’re a seasoned property investor or just dipping your toe into purchasing your first investment property, you will have come across the term ‘negative gearing’ on one of those late nights spent poring over property listings.

With more than 2.2 million Australians owning a rental property and a thriving local rental market, negative gearing continues to be a focus for property investors. But what exactly is negative gearing, and how can you use it to your advantage in Australia’s competitive property market?

In this article, we’ll look at the advantages, disadvantages, and considerations that investors need to take into account when it comes to negative gearing and property.

What is Negative Gearing?

In simple terms, negative gearing simply refers to a real estate investment strategy in which the income generated from the property is less than the expenses incurred, resulting in a net loss against the property.

For real estate investors, this net loss can be offset against other income, which reduces the investor’s tax liability at the end of the financial year. Costs incurred through the property such as mortgage interest, insurance, repairs and maintenance, and property management fees are written off as a “loss”, reducing an investor’s tax liabilities.

So, losing money as a strategy to minimise tax – how does that make sense?

Well, if you’re a property investor, the goal of negative gearing is to generate capital growth over the long-term, which means that a profit is not realised until the property is sold in the proceeding years.

As far as investment strategies go, negative gearing is considered “high risk” and extreme care should be exercised when it comes to negative gearing. Fluctuations in property prices, rental income, as well as changing interest rates mean that negatively geared property investors are exposed to a myriad of risks that are often beyond their control.

It’s also important to remember that negative gearing will not always result in a tax advantage. Factors such as individual taxable incomes and tax brackets will influence how effective negative gearing will be as an investment strategy.

Advantages of Negative Gearing

The use of negative gearing is one of the most common investment strategies used in Australia and it can provide several benefits for those investors who understand this method and can effectively implement such a strategy. There are multiple advantages of negative gearing for investors, so let’s take a closer look.

1. Tax Benefits

The key advantage of negative gearing is the significant tax benefits that investors can benefit from. When a negative gearing strategy is executed correctly, it reduces your taxable income and how much tax you will pay each year. Any losses incurred from the investment property can be offset against other income that you earn, such as your salary.

2. Capital Growth

Despite making a loss, your property’s capital value can still rise over time. Particularly in the long term, the value of your investment property will hopefully increase significantly, creating substantial capital growth.

3. Diversification of Investment Portfolio

Diversifying your investment portfolio is vital. Diversification of your investment portfolio lowers your overall risk and means that you are less susceptible to market shifts. Instead of solely relying on traditional investments such as stocks and bonds, an investment property provides you with a completely different source of income, reducing your portfolio volatility.

4. Increased Rental Income and Cash Flow

Even if a property is negatively geared, it can still create positive cash flow and generate rental income.

Additional cash flow can also be generated through depreciation. Depreciation is recorded as a loss in your books, but it is not actually money being spent on the property. However, when it comes to tax time, it is incorporated within your total expenses. As a result, total expenses increase, which increases tax deductions and, most importantly, your tax refund!

5. Capital Gains

Capital Gains tax applies to all your investment properties. However, a discount can be granted when a property is negatively geared.

While the benefits associated with negative gearing are genuine, it is vital to remember it is not the right strategy for everyone. Always take careful consideration of your personal circumstances and seek advice from investment experts when it is necessary.

Disadvantages of Negative Gearing

You will notice that many disadvantages of negative gearing relate to similar concepts as the advantages. Therefore, it is crucial to be certain of your investment strategy and seek an expert’s advice if you need to.

If you are contemplating a negative gearing investment, consider the following disadvantages.

1. Reduced Cash Flow

Negative gearing is reliant on regular rental payments. If you are not receiving recurring rental income on the property, you will not be able to cover the difference between the expenses and the income generated from the property, reducing your overall cash flow.

2. Dependence on Capital Gains

A negative gearing investment strategy relies on the assumption that the property’s value will increase over time. The appreciation of the property allows the investor to recoup the cost and make a profit when they sell the property. However, if your property does not increase in value, you risk not making this money back and potentially making a loss.

3. Increased Financial Risk

The negative cash flow associated with negative gearing creates substantial financial risk. As the investor, you are required to cover the shortfall each month and if it is not dealt with, this will worsen over time.

4. Limited Property Market Appeal

The term ‘negatively geared’ comes with negative connotations. If your property is negatively geared, it is more difficult to attract renters or buyers. This will lead to issues in cash flow if you are struggling to rent out the property and will provide immense challenges if you try to sell the property.

5. Increased Tax Liability

As an investor, negative gearing can increase your tax liability in the future. When you sell the property, any capital gain you make will be taxed at your marginal tax rate.

We understand that this is a lot of information. Negative gearing is a complex investment strategy and should be implemented with caution and care. If you are nervous about entering into this type of arrangement, use this instinct as a warning sign and feel free to reach out to one of our experts who can provide you with the advice you need.

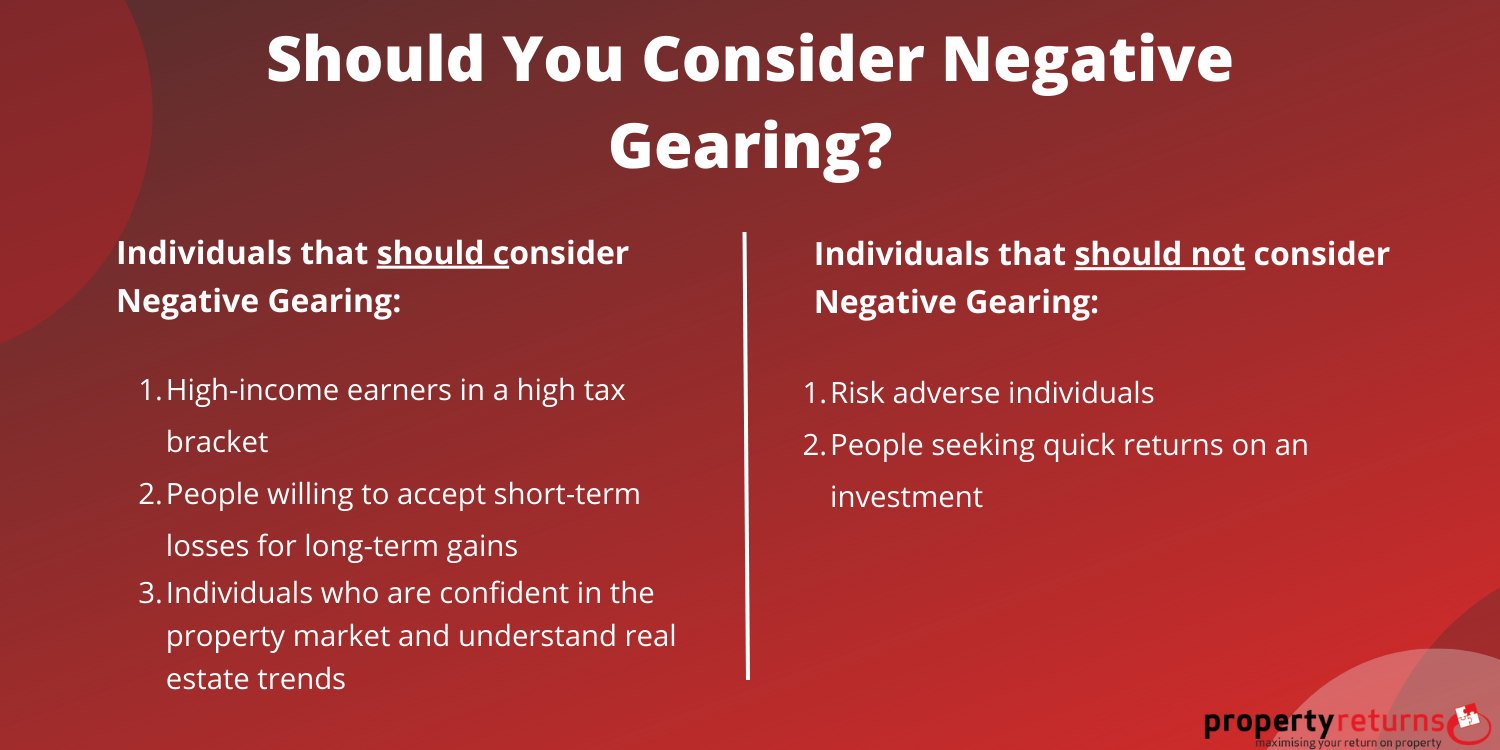

Who Should Consider Negative Gearing?

Negative gearing can be a very effective investment strategy, but it is not suitable for everyone. If you are considering entering this type of arrangement, you need to ensure you are confident in the property market and comfortable with making short-term losses for long-term gains.

If you fall within any of the below categories, negative gearing is a good investment strategy for you to consider.

- A high-income earner in a high tax bracket – When you fall within the higher tax bracket, the losses generated by the negative geared investment can be used to offset taxable income and potentially reduce your tax bill.

- Willing to accept short-term losses for long-term gains – If you have a long-term investment strategy, the losses generated in the short-term will be outweighed by the capital gains made when the property is sold in the future. The capital gain is of course reliant on the appreciation of the property.

- Confidence in the property market and understanding real estate trends – Property markets fluctuate. You need to be comfortable with this fact and understand what it means for your investments and the fluctuation of their valuation.

Conversely, if you fall within the below categories, negative gearing is not your best investment option.

- Risk-averse individuals – Negative gearing comes with a lot of risks; there is no denying that. If higher-risk strategies make you nervous or it is outside your financial capability, a negative gearing investment is not suitable for you.

- Individuals seeking quick returns on investment – When it comes to negative gearing, patience is vital. You need to be willing to accept short-term losses to achieve long-term gains. If you are looking for quick income, negative gearing is not the right strategy.

Our Final Advice on Negative Gearing

There is no denying the opportunity associated with negative gearing. As an investment strategy, it offers you the chance to obtain significant tax benefits, diversify your portfolio, and generate substantial income and cash flow.

However, it is a risky strategy that requires patience and market knowledge. If you are risk-averse and looking for a quick win, negative gearing is not the best strategy, especially compared to positive gearing.

At Property Returns, we are the experts when it comes to negative gearing, quantity surveying, and tax depreciation schedules for property investments. With 40 year’s experience and extensive knowledge of the Australian market, we are here to help you tackle this complex field and choose the right investment strategy.

Leave A Comment