A depreciation schedule is a certified report that details all available tax depreciation deductions within residential investment properties or commercial building.

Almost all properties – whether old or new – have depreciation and tax return to be claimed. A depreciation schedule can only be completed by a qualified quantity surveyor.

In this article, Property Returns are going to outline the tax depreciation schedule costs and the factors that influence how much the cost for a thorough depreciation schedule is.

Let’s start with the basics.

What Is a Tax Depreciation Schedule?

Obtaining a depreciation schedule is an essential step taken by any property investor looking to minimise their tax, maximise their investment and claim deductions. The depreciation report outlines to different claims, allowances, and depreciation entitlements.

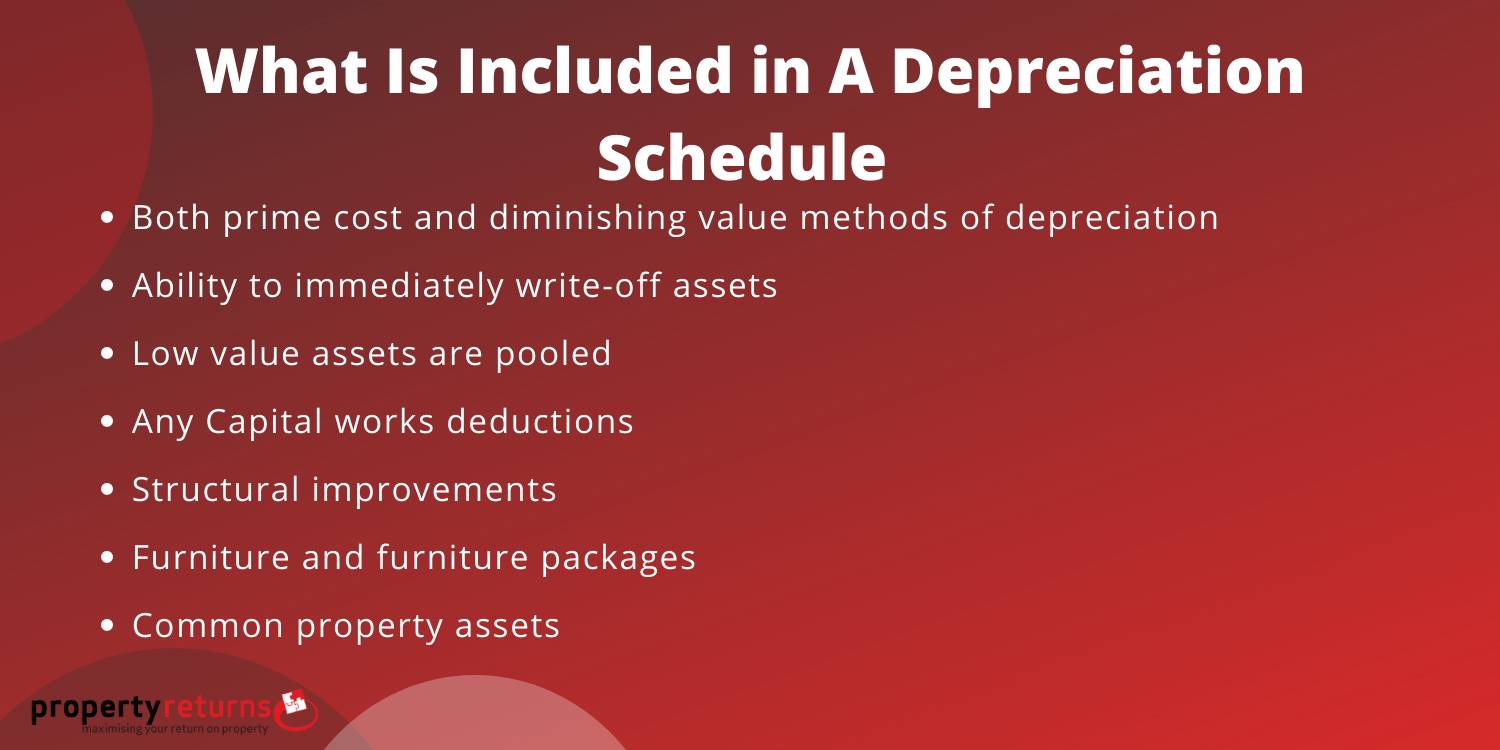

1. The building capital (DIV43) which can be claimed as an allowance.

2. The plant (DIV40) which can be claimed as a depreciation expense.

Both are outlined in relation to the financial years they are owned by the investor and will determine an annual depreciation claim. Any investor will require a property depreciation schedule for any established investment property in Australia for a financial year. The schedule will allow them to establish a timeline that contains all necessary details about the history of the investment property.

These details usually include the property’s original construction costs and completion date and any previous owners’ renovation work that affects its value.

Factors Impacting Depreciation Schedule Costs

Typically, you should calculate between $385 to $770 for tax depreciation schedule costs from an experienced surveyor. There are several factors that influence ‘how much do a tax depreciation schedules cost?’, including:

Factors Influencing Costs for Tax Depreciation Schedules

1. Type Of Property

The property type of your investment will dictate how much you will have to pay to a licensed property surveyor. Larger, commercial properties will command a higher price than smaller apartments. Brand new properties will also see a more discounted fee than more expensive, already established residential properties, this is because a brand-new property has plans, inclusions and other construction costs are easily available, and accurate.

2. Complexity Of the Work

Research will need to be conducted by the surveyor before a complete depreciation schedule can be formulated. Physical property inspections combined with online research will help provide a thorough schedule. The more detailed this research and property inspection is, the more you can expect to pay as there is a labour charge incorporated into the cost.

3. Quality of the Services

While property investors can save money by engaging the services of a cheaper provider, a more expensive provider can often provide a much higher level of service and ensure you receive more aggressive tax deductions for your cash flow. A knowledgeable, reputable provider can be the difference in ensuring your deduction is ATO compliant and a more accurate valuation.

Doing Your Own Depreciation Schedule

Completing your own depreciation is possible, with many companies offering a self-assessment depreciation reports. However, the issue here is that you are not an expert in depreciation and are not aware of the things you need to consider. Missing even a few things on a checklist will make a significant difference to your final claim amount. Paying the extra cost for a thorough inspection to take place will ensure there are no missed deductions, and you won’t have to go to the property yourself to complete the assessment. So, whilst your tax depreciation schedule cost might be lower, you might miss out on more substantial tax benefit claims.

How Many Depreciation Reports Do I Need To Do?

One additional factor impacting ‘how much does a depreciation schedule cost?’, is the fact that you should only need to do it once. Once you have completed the schedule, your accountant will use it over the lifetime of your property. However, should your property undergo any major changes, you may require a new depreciation report. A meticulous tax depreciation schedule should only be a single cost when done correctly. If you are considering making any significant changes to your property, consult with a member of your team to ensure you do not miss out on claiming tax deductions.

Can My Accountant Do My Depreciation Schedule?

Unlike quantity surveyors, accountants are not recognised by the Australian Taxation Office as having the appropriate skills or certifications to estimate construction costs and asset values. A qualified quantity surveyor is experienced in assigning values to assets in property and knowledgeable on relevant legislation that applies to tax depreciation. It is always worth investing in a surveyor who is compliant to ATO requirements and will secure your claim on tax deductions you are entitled to.

How Much Does a Depreciation Schedule Cost with Property Returns?

At Property Returns, we understand that every property and is unique, whether residential or commercial property. Depreciable assets to your cash flow age differently over time, and we recognise all the ATO’s rules regarding the depreciation deductions of assets.

A member of our expert team of quantity surveyors in Melbourne can guide you through the depreciation schedule to ensure you are receiving any tax deduction you are entitled to. Our quantity surveyors gather all relevant data relating to your property purchase, any historical information surrounding the building structure, plus all associated improvements to it. By doing this, Property Returns produces the most accurate depreciation schedules for all our clients that maximise the tax savings for the lifetime of the property ownership.

If you are looking for more information on ‘what are the costs on depreciation schedules?’ or if you’re looking to pay less tax and get the most out of your portfolio with qualified quantity surveyors, no matter where you are in Australia, get in touch with us today on our website or call us on 1300 829 221 for tax advice, or even order a schedule online to get started.

Leave A Comment